[Via Satellite 06-12-2015] Despite the downturn in the global energy market, demand for greater throughput is continuing to drive the need for remote connectivity. This trend influenced Canada’s Galaxy Broadband Communications, a satellite communications company focused on resource, government, and enterprise markets in North America, to recently enter a long-term capacity deal with Telesat. The agreement, announced late last month, makes the company one of Telesat’s biggest Ka-band customers in Canada’s North.

“The mining and resource sectors, oil and gas, and mining in particular, are off. There is not as much exploration going on; the drill rig counts are through the floor; the number of miners that have funding to go out and to conduct exploration, that number is reducing this year, but those that are, they need a stronger connection. That connection is worth money to them. They need to be connected and they appreciate the value of what we do,” Rick Hodgkinson, president and CEO of Galaxy Broadband, told Via Satellite.

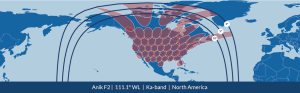

Galaxy Broadband leased multiple Ka transponders on Telesat’s Anik F2 satellite, adding to previously secured capacity on Anik F3. The company also leases a large amount of Ku-band capacity on Intelsat’s Galaxy 16 satellite. Hodgkinson said the Ku-band network does not reach as far north, prompting the company to look toward a Ka solution. Galaxy Broadband operates seven different hubs based out of Toronto and Vancouver to reach all of Canada.

To meet the higher throughput demand from Northern Canada’s atrophied but active energy and mining sector, Galaxy Broadband also recently launched a network specifically targeted to large work camps using Ka band. Named SkyCarrier, the platform is the company’s fourth generation IP over satellite service.

“On a 1.2-meter antenna 3W configuration, we deliver 9 Mbps on the upload and up to 50 Mbps on the download with very high Committed Information Rates (CIR),” he said. “It used to be a couple years ago that they wanted a connection. Now they need it, and reliability and predictability are the catchwords. They cannot deal with high latency and jitter, or latency that’s ‘all over the map’ like you see in shared networks. That’s the trend we see: for stronger, more robust links to these sites.”

Galaxy Broadband was also motivated to secure capacity sooner rather than later because of the current turmoil in the launch sector.

“We felt that, given the current situation with upcoming satellite launches coupled with our existing customer base, we wanted to secure that space on Anik F2 until virtually the end of life,” added Hodgkinson.

For Telesat, energy and mining customers are also a top focus. Michele Beck, vice president of North American sales at Telesat, told Via Satellite both tend to have remote operations with similar requirements for bandwidth and reliability, typically with sizeable data files. The operator is confident that these customers in Canada and throughout the continent will continue to form a stable customer base.

“In North America, the exploitation of energy and mining are typically in remote, unserved or underserved locations, so they tend to require satcom solutions. Satcom demand in this sector has obviously been affected by the global oil glut that has reduced exploration and recovery activities, but the recently announced deal between Telesat and Galaxy Broadband reflects strong support for the long term growth prospects of this sector,” she said.

Energy and mining customers in Northern Canada are particularly important for Telesat given the dichotomy between commercial or government customers and residential broadband users. Beck said energy and mining customers often see satellite communications as well worth the cost thanks to benefits in operational efficiency and the improvements in morale and safety for on-site personnel.

However, rural communities that want broadband access similar to that of major urban centers located further south are less inclined to opt for satcom solutions. Maintaining affordable retail service rates is a challenge, she said, particularly because remote communities elsewhere in the world tend to have many times the population of communities in Canada’s Far North.

Hodgkinson said in the future he expects video in the land drilling markets will be become a more prominent sector. Uplink speeds for video services such as telemedicine will rise concurrently in importance, he said. Similarly, Beck expressed confidence that, in the next two to three years, the outlook for Canada’s north is favorable.

“We obviously do not know how this will all play out the next few years but Telesat is confident that GEO satellites with C-band, Ku-band and Ka-band payloads will remain the best choice for connecting remote oil, gas and mining operations,” she said.

The post Climbing Throughput Needs Upholding Satellite Demand in Canadian Energy Sector appeared first on Via Satellite.